The Hidden Math Behind Shared Leads: Are You Buying Jobs or Just Data?

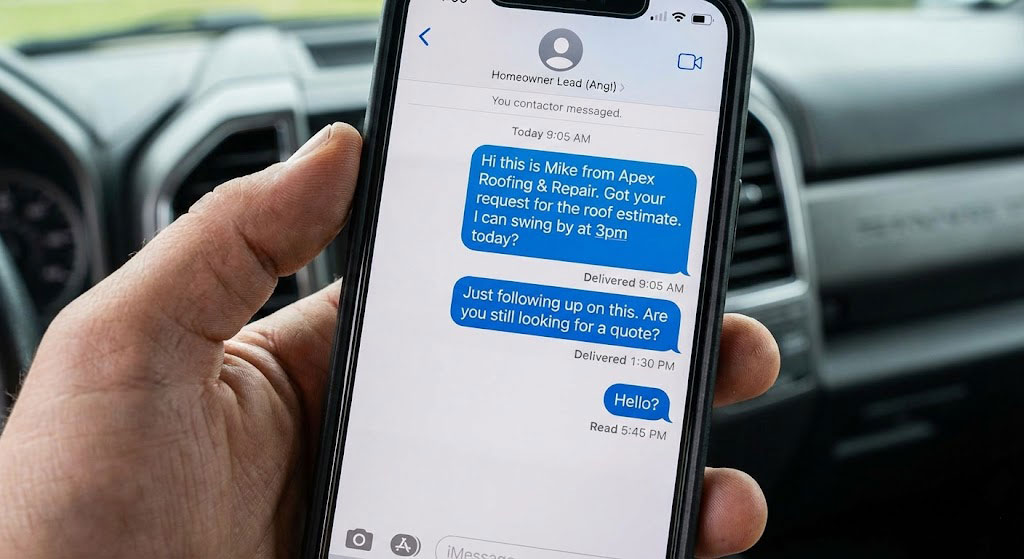

Picture this: Your phone buzzes with a new lead notification. You drop what you’re doing, pull over to the side of the road, and call the number within 60 seconds.

A homeowner answers, sounds confused, and says, “Oh, thanks for calling, but I already spoke to three other guys and hired one of them.”

It’s a punch in the gut. You just paid $65 for that 20-second rejection call.

This is the daily reality for thousands of contractors relying on lead aggregator platforms like Angi and HomeAdvisor. As we head into 2026, the question isn’t just which one is better—since they are now essentially the same company under the ANGI Homeservices umbrella—the real question is: Are their “shared lead” models still a viable way to build a profitable business?

At MassMonopoly, we believe in transparency. We don’t sell black boxes; we build systems that you own. So, let’s put aside the sales pitches and look at the cold, hard math of buying shared leads in today’s market.

The “Shared Lead” Reality Check

The fundamental problem with platforms like Angi Leads (formerly HomeAdvisor) isn’t the platform itself; it’s the business model. They are in the business of selling data, not securing jobs for you.

When a homeowner submits a request for a “roof replacement,” that lead is typically sold to 3, 4, or even 5 different contractors simultaneously.

Suddenly, you aren’t a trusted advisor arriving for a consultation; you are a commodity in a speed-dial race to the bottom. The homeowner is overwhelmed by calls, and the first contractor to get through often wins by default, or the conversation immediately pivots to price before value can ever be established.

This “speed-to-lead” pressure is intense. If you aren’t calling within the first 5 minutes, your chances of connecting drop dramatically. For a busy contractor on a job site, that’s an impossible standard to meet consistently.

The True Cost: Doing the “Napkin Math”

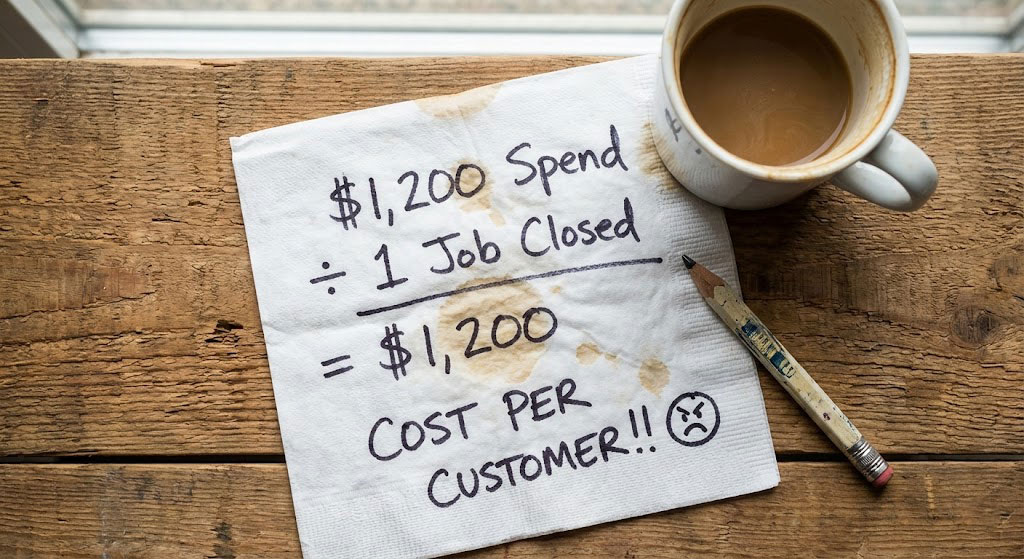

Many contractors look at the “cost per lead” (CPL) and think it sounds reasonable. A $50 lead for a $10,000 project? Sign me up.

But CPL is a vanity metric. The only number that matters is your Cost Per Acquisition (CPA)—how much you spend to actually deposit a check from a new customer.

Let’s break down a realistic scenario for 2026:

- You buy 20 leads at an average of $60 each.

- Total Spend: $1,200.

- The Reality: Out of those 20 leads, 5 are “ghosts” who never pick up. 5 are just “kickin’ tires” or price-checking. You manage to quote the remaining 10.

- The Competition: Because you’re fighting 4 other contractors for every one of those quotes, a realistic close rate on shared leads is often around 10-15%.

- The Result: You close 1 or 2 jobs from that $1,200 spend.

Your Cost Per Acquisition isn’t $60. It’s **$600 to $1,200 per customer**.

Can you build a profitable business with those margins? For most trades, the answer is no. You are essentially paying a “tax” on every job to a third party that owns the relationship with your customer.

“You end up spending $1,200 to close one job. For that same budget, you could have funded an entire month of your own exclusive marketing system.”

The “Ghost Lead” Epidemic

Another major frustration we hear from contractors is lead quality. As we head into 2026, homeowners are more digitally savvy than ever. They use these apps to get a quick ballpark price for a project they might do “someday,” with zero intent of hiring anyone right now.

Yet, the platform still packages that data up and sells it to you as a “hot lead.”

You pay for the name and number, regardless of whether they are ready to buy. While some platforms offer a credit process for bad leads, it’s often a time-consuming bureaucratic hurdle that many contractors just give up on. You end up paying for the privilege of chasing people who don’t want to be caught.

Is There Ever a Time to Use Them?

To be fair and balanced, there is one specific scenario where these platforms can serve a purpose.

If you are a brand-new business with zero online presence—no website, no Google reviews, no reputation—and you need cash flow next week to keep the lights on, then buying leads can act as an expensive crutch. It’s a way to buy your way into the market temporarily.

But it should never be your long-term strategy. It’s a hamster wheel: as soon as you stop paying, the phone stops ringing. You are building their brand, not yours.

The 2026 Solution: Stop Renting, Start Owning

The most successful, scalable contracting businesses in 2026 are shifting their mindset. They don’t want to rent their leads; they want to own the source.

When you invest in your own professional website and a strong local SEO strategy, something powerful happens:

- Exclusivity: When a homeowner finds your site on Google, reads your reviews, and fills out your contact form, that lead is 100% yours. You aren’t sharing it with anyone.

- Higher Intent: A prospect who actively searches for you, consumes your content, and decides to contact you is far more qualified than someone who clicked a button on an app.

- Higher Close Rates: Because the lead is exclusive and higher quality, your close rate on owned leads can easily be 40-60%, compared to the abysmal 10% on shared platforms.

- Long-Term Asset: Your website is a digital salesperson that works for you 24/7/365, building equity in your own brand name year after year.

At MassMonopoly, we specialize in helping contractors break free from the shared lead trap. We build high-converting “Growth Hubs” that turn your website into your primary lead generation engine.

Are you ready to stop fighting for scraps and start owning your market? Let’s talk about a better way to build your business. Learn more about our exclusive contractor lead generation system today.